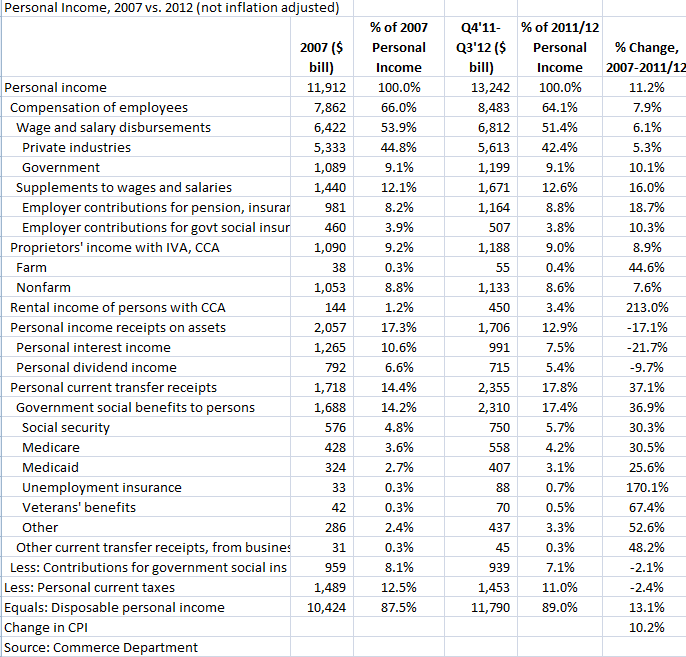

The personal income data in the GDP accounts provides good insights into structural changes in the U.S. economy. We compare the most recent figures (four quarters ending Q3 2012) with 2007. These are nominal data, i.e., not adjusted for inflation. Key trends:

- Personal income is barely beating inflation. Since 2007 it rose 11.2% vs. a 10.2% rise in the CPI. This partly reflects Washington’s war on employment, as well as fairly strong commodity prices.

- Because taxes are down slightly, Disposable Personal Income is a little stronger, up 13.1%. So disposable income is up about 3% after inflation. However, U.S. population rose about 4.3% over this period, so real personal disposable income per capita declined slightly, 2007-2012. We are getting poorer, but the media still does not think we pay enough taxes.

- Spendable income is even weaker; “wages and salaries” – the compensation you can waste at the mall – grew just 7.9%, although admittedly it was supplemented by certain transfer payments, which are booming (see below). The other component of compensation, “supplements to wages and salaries” (i.e., corporate benefits such as pensions and health insurance) grew much faster, 16.0%. This is bullish for healthcare stocks, if you can find one not squeezed by government policies. Obamacare accelerates this rapid growth in non-spendable income by mandating a costly basic health insurance package.

- Government is growing twice as fast as the private sector. Private wages and salaries grew 5.3%, vs. 10.1% for government wages and salaries. Don’t believe those who complain the only reason employment is weak is that conservatives are starving government; private employment collapsed early in the recession while government employment was still growing. (See my June 29 post.)

- Farm income is booming, up 44.6% vs. just 7.6% for nonfarm. Bullish for ag stocks like Deere, whose earnings have held up quite well; its little-noticed construction equipment business (17% of revenue) is benefiting from an upturn in building activity. Buffett recently bought the name. I own a little.

- Government transfer payments are through the roof, up 37%. The terrible troika – Social Security, Medicare, Medicaid – are all up 30-37%, but unemployment insurance is up a huge 170%.

All in all, not a pretty picture, and set to get worse as taxes rise and transfer payments are pared back. Next year uninsured individuals have to pay the Obamacare tax, cutting spendable income even more. Euro-sclerosis, here we come. Real personal disposable income per capita is declining, even though government transfer payments are soaring. Wages and salaries are much weaker than overall personal income, and the wages and salaries of workers in the private sector dramatically lag the public sector. Among the few “sweet spots” in the U.S. economy are writing regulations in Washington DC and growing corn and soybeans in Iowa.

Copyright 2012 Thomas Doerflinger. All Rights Reserved.